Eliot Spitzer, featured prominently in the documentary "Inside Job", may feel vindicated that much more by the film's Oscar win last night.

Then again, no one watches the Oscars, anymore. But had they tuned in, they would have heard the only political statement of the night, delivered by Director Charles Ferguson:

“Forgive me, I must start by pointing out that three years after our horrific financial crisis caused by massive fraud, not a single financial executive has gone to jail, and that’s wrong,” Mr. Ferguson said.

Additional congrats and thanks should go to Jeff Lurie, the owner of the Philadelphia Eagles, who bankrolled the film.

"Inside Job" provides a strong overview of the financial crisis, but it does pull a few punches, partially because additional information about the TARP distribution was only made available this past December, long past the completion of the film.

That additional information was only made available through Bernie Sanders' amendment to the financial reform bill. It's been largely under-reported, but "Draft Spitzer" plans an upcoming post on the issue.

Monday, February 28, 2011

Spitzer's Bipartisan Appeal

Judy and tb had posted comments in response to the Sanders post. I tried to address tb's understandable lack of faith in the U.S. electorate in the comment section, but I think the reply, amended slightly, warrants an actual post. Here goes:

If it's any comfort (and, one hopes, some inspiration), Spitzer was the only Democratic politician who consistently polled higher with men than with women, based largely on his tough, law-and-order position on white-collar-crime. That may indicate that Americans were never as hypocritical, prudish, or stupid as the corporate-controlled media would like them to be. The trick is circumventing the media's obsession with sex scandals to get the message out about the reforms Spitzer actually accomplished as New York State Attorney General.

Spitzer's formidable accomplishments in that role may be an increasingly strong motivation for voters amid the ongoing corruption of the banking sector. Even motivation among Republicans.

Ironically, Spitzer's work as Attorney General in New York makes an intriguing conservative argument for the efficacy of State governments over the ineptitude of the Federal Government. In the late-trading case against Canary Capital/Bank of America, Spitz accomplished in a matter of months what the Feds would take years to do - if they did it at all. Which, as we all know, they didn't.

Full disclosure: I have quite a few conservative friends who genuinely respect and appreciate Spitzer's work as Attorney General. They're not about to support him for a presidential bid, but we all agree that he should at least have an essential role as the head of a new Pecora Investigation or as a candidate for U.S. Attorney General.

There is common ground between ordinary people on both right and left when it comes to bank reform. I always suspected that, but I would never have known if I had not reached out to "the other side" and tried.

The problem is, whenever we find "real" bipartisanship (e.g., bipartisanship that works for ordinary citizens, rather than the malefactor banks) we get shouted down. It has, sadly, given bipartisanship a bad name. I've occasionally taken a good deal of heat for continuing to seek said common ground, and the effort itself hasn't exactly been a picnic or necessarily successful (understatement of the year), but I'm still trying.

Why? Because I think one way the malefactor banks have been able to exploit their advantage is the media's desire to split the electorate into "right" and "left" orthodoxies. But when it comes to Bank of America, Citigroup, Goldman Sachs, et alia, there have been many, many voices on both right and left who desire the exact same reforms.

If it's any comfort (and, one hopes, some inspiration), Spitzer was the only Democratic politician who consistently polled higher with men than with women, based largely on his tough, law-and-order position on white-collar-crime. That may indicate that Americans were never as hypocritical, prudish, or stupid as the corporate-controlled media would like them to be. The trick is circumventing the media's obsession with sex scandals to get the message out about the reforms Spitzer actually accomplished as New York State Attorney General.

Spitzer's formidable accomplishments in that role may be an increasingly strong motivation for voters amid the ongoing corruption of the banking sector. Even motivation among Republicans.

Ironically, Spitzer's work as Attorney General in New York makes an intriguing conservative argument for the efficacy of State governments over the ineptitude of the Federal Government. In the late-trading case against Canary Capital/Bank of America, Spitz accomplished in a matter of months what the Feds would take years to do - if they did it at all. Which, as we all know, they didn't.

Full disclosure: I have quite a few conservative friends who genuinely respect and appreciate Spitzer's work as Attorney General. They're not about to support him for a presidential bid, but we all agree that he should at least have an essential role as the head of a new Pecora Investigation or as a candidate for U.S. Attorney General.

There is common ground between ordinary people on both right and left when it comes to bank reform. I always suspected that, but I would never have known if I had not reached out to "the other side" and tried.

The problem is, whenever we find "real" bipartisanship (e.g., bipartisanship that works for ordinary citizens, rather than the malefactor banks) we get shouted down. It has, sadly, given bipartisanship a bad name. I've occasionally taken a good deal of heat for continuing to seek said common ground, and the effort itself hasn't exactly been a picnic or necessarily successful (understatement of the year), but I'm still trying.

Why? Because I think one way the malefactor banks have been able to exploit their advantage is the media's desire to split the electorate into "right" and "left" orthodoxies. But when it comes to Bank of America, Citigroup, Goldman Sachs, et alia, there have been many, many voices on both right and left who desire the exact same reforms.

Saturday, February 26, 2011

Bernie Sanders on Eliot Spitzer

"DraftSpitzer" attended Bernie Sanders' speech in San Francisco last night, and took the opportunity, post-speech, to buttonhole the 70-year-old Brooklyn-born Senator on the issue of Eliot Spitzer. This occurred while the jet-lagged, septuagenarian was trying to get through inscribing many boxes of books for his ravenous fan base. (The event was sold out, and Sanders had just delivered a rousing, populist speech.)

So, okay, maybe it wasn't the best time to ask about Eliot Spitzer, but DraftSpitzer figured this might be the only opportunity. Here's the breakdown:

DraftSpitzer: (interrupting actual book buyer, who wanted her book inscribed to Uncle Basil, or some such piffle) "Senator Sanders, do you think there's hope for a resurrection of Eliot Spitzer?"

Senator Bernie Sanders: (furrowing brow) "Spitzer? Well, he has a talk show on CNN."

DraftSpitzer: (panicky) "But... a talk show? That's not enough!"

Granted, it wasn't the wild endorsement one might hope for. Hadn't the Senator seen Alex Gibney's "Client 9: The Rise and Fall of Eliot Spitzer"?

To be fair, Senator Sanders had only flown in that afternoon, and by the time he finished speaking, it was after midnight Eastern time. Otherwise, I'm sure he would have sung the many praises of Eliot Spitzer. Because... who wouldn't?

Chalk it up to a Brooklyn-Bronx rivalry.

So, okay, maybe it wasn't the best time to ask about Eliot Spitzer, but DraftSpitzer figured this might be the only opportunity. Here's the breakdown:

DraftSpitzer: (interrupting actual book buyer, who wanted her book inscribed to Uncle Basil, or some such piffle) "Senator Sanders, do you think there's hope for a resurrection of Eliot Spitzer?"

Senator Bernie Sanders: (furrowing brow) "Spitzer? Well, he has a talk show on CNN."

DraftSpitzer: (panicky) "But... a talk show? That's not enough!"

Granted, it wasn't the wild endorsement one might hope for. Hadn't the Senator seen Alex Gibney's "Client 9: The Rise and Fall of Eliot Spitzer"?

To be fair, Senator Sanders had only flown in that afternoon, and by the time he finished speaking, it was after midnight Eastern time. Otherwise, I'm sure he would have sung the many praises of Eliot Spitzer. Because... who wouldn't?

Chalk it up to a Brooklyn-Bronx rivalry.

Spitzer on "Self-Regulation" and "Powerful Friends"

"So, what are the principles? Rule number one: Only government can ensure integrity in the marketplace. Now that seems like such an obvious statement, but nobody believed it three, four, five years ago. There was this canard, this oxymoron, called 'self-regulation.' We can all sit here and roll our eyes, but that was the governing ideology for a long time. And when I would go down to Washington and we’d bring out cases and I would say “Self-regulation doesn’t work,” people would say, 'Oh, come on, you’re just some left-over from the 1960’s....'

"This was a very difficult fight. And the story that brought it home to me was our case against investment bank Merrill Lynch. And it had to do with the tension that existed between underwriting IPO’s and secondary offerings on the one hand, and also having analysts simultaneously recommend those stocks to the investing public, which we thought was a conflict of interest. Jack Grubman, one of the analysts involved in all this, captured the moment in time when he said, 'What used to be viewed as a conflict of interest is now viewed as a synergy.'

"What happened in this case… we found the needles in the haystacks. And we were about to file the case. My first introduction to this type of litigation was when the lawyer from Merrill called me up and said, “Eliot, I’m warning you, we have powerful friends.” And I said, 'Well! That’s an interesting legal argument. They didn’t teach me that in law school.' (Laughs.) What am I supposed to say?

"Nonetheless, we filed the case, and the Merrill lawyers came in and said, 'Eliot, you’re absolutely right, but we’re not as bad as our competitors.' And that was their defense!

"The point was this: when it came to a choice where they knew the behavior was problematic, sacrificing that integrity vs. market share, they sacrificed integrity. The reality was that the marketplace drove behavior down to a standard that was simply unacceptable, and the only entity that could come in and say 'Stop, that’s not acceptable,' was government."

Spitzer on Chinese versus U.S. Investment.

“Where is capital being invested and by whom? China is buying up the natural resources around the world, something we used to do, while we are paying for soldiers in Afghanistan…. We need a government at this moment that is nimble, quick, can respond, and make smart investment decisions. Unfortunately, this is the very moment when our government is failing us."

We didn't listen to Spitzer when he tried to warn us about AIG. And look what happened: the U.S. taxpayer ended up forking over $180 billion for the shell of a company, in what Spitzer rightly described as the scam of the century.

Maybe we should start listening to Spitzer. Now.

Spitzer on Alan Greenspan

"...Alan Greenspan's autobiography - I read it with shock, because I said, 'This guy was Chairman of the Fed - that's supposed to be a regulatory interventionist position - and this guy is singing the praises of Ayn Rand left, right and center.

"But that was the accepted dogma. It began with President Reagan, and it dominated the intellectual discourse of the country from that moment until a year ago. We’ve gone from Ayn Rand libertarianism to having Ken Feinberg appointed to set the salaries of senior execs at companies across the board.

"How did we span that spectrum so quickly? How do you go from one intellectual extreme to the other? And does that mean that there are no real intellectual moorings? And can we construct some meaningful set of principles that will permit us to understand what government should do and why? Because if we can’t do that, then we’ll be just coming up with ad hoc decisions without any coherent argument.”

Thursday, February 24, 2011

Eliot Spitzer on the "White Collar-ization" of Organized Crime

Ever wonder what the Gambinos and Goldman Sachs have in common?

In response to a question about "organized crime" last year at The Commonwealth Club in San Francisco, Former Attorney General Eliot Spitzer had this to say:

"We’ve gone through what I call the white collarization of organized crime. The smart organized crime figures realized the people who really make money are the folks who get together, create a monopoly, take over an industry, increase prices by 10 or 15 percent, and do very nicely.

"That beats by a long margin running a loan sharking operation on the street corner beating somebody over the head with a baseball bat, because when you hit somebody over the head with a baseball bat, the cop comes and arrests you.

"When you create a monopoly, it looks like white collar crime, and they say, eh, we don’t fuss with that.

"And so that’s what happened. In the case I prosecuted involving the Gambino family, trucking, and the garment district, they'd formed a clever cartel. And we prosecuted them under the New York State anti-trust law, which actually preceded the Sherman Act. That’s what we did.

"So what we call traditional organized crime - the sort of organized crime you’d see in the Godfather movies - really went through that transformation. But let’s not kid ourselves. Organized crime is there, it moves in terms of ethnicity, it moves in terms of geography, it moves in terms of subject matter, it will always be there, but there really was what I call this white collar-ization."

Editor's note: I'd like to make very clear that Spitzer did not state in any way that Lloyd Blankfein was a member of any organized crime cartel. He simply pointed out that organized crime does not necessarily look like what we expect it to look like. And Spitzer had other, far more interesting things to say about Goldman Sachs that evening. Specifically he talked about his efforts to make all the emails between AIG and its counterparties (including Goldman Sachs) available to the public. But more on that in another post.

Editor's note: I'd like to make very clear that Spitzer did not state in any way that Lloyd Blankfein was a member of any organized crime cartel. He simply pointed out that organized crime does not necessarily look like what we expect it to look like. And Spitzer had other, far more interesting things to say about Goldman Sachs that evening. Specifically he talked about his efforts to make all the emails between AIG and its counterparties (including Goldman Sachs) available to the public. But more on that in another post.

Saturday, February 19, 2011

Why Spitzer?

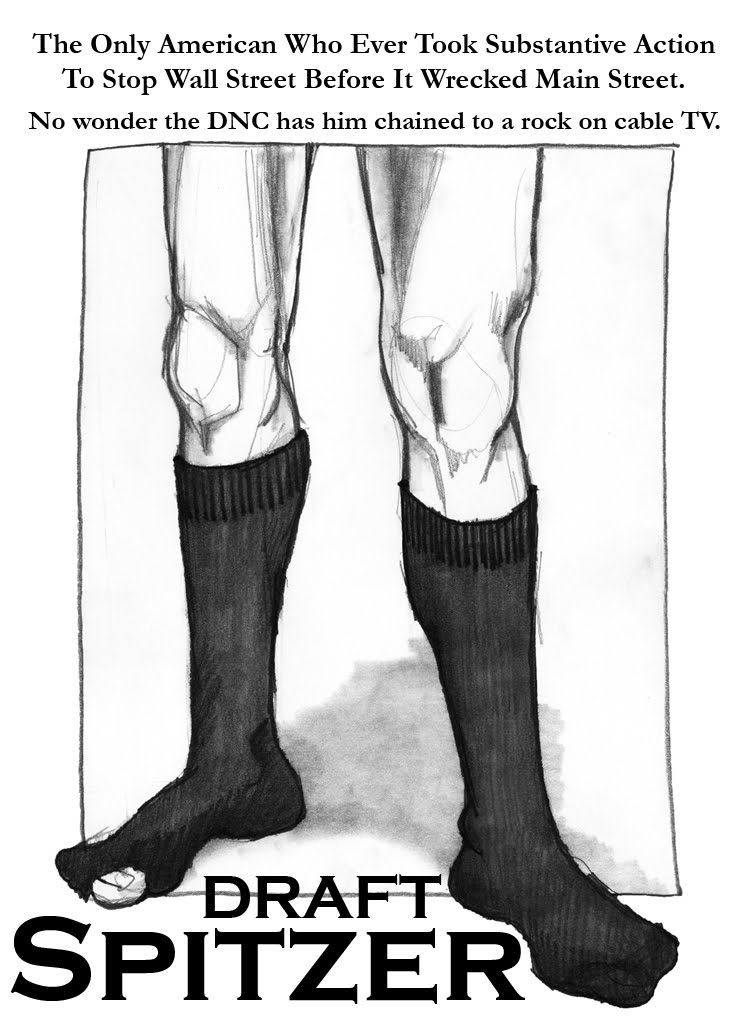

The fact is that most of us ordinary folk just don't care about the hypocritical 80 grand he threw away on call girls, or even the black socks. We're too focused on clawing back the TRILLIONS the government blew on malefactor banks, which aren't loaning it back to small businesses.

And if there's one man who could actually get it back, it's Spitzer.

And if there's one man who could actually get it back, it's Spitzer.

What Is The Regulatory Charade?

From Spitzer's presentation at the Commonwealth Club:

“What we are doing is what I call the Regulatory Charade. What do I mean by that? After a crisis of this sort – and it doesn’t matter whether it’s the Enron crisis which generated Sarbanes-Oxley or other crises – there is always the rush to pass a law. Why do we want to pass a law? The virtue of passing a new law is that malefactors in the private sector get to say: ‘Go pay attention to passing a new law, but don’t worry about prosecuting us.’ And the regulators who should have done something can stand up and say: ‘We would have stopped it but we didn’t have the power, so pass a new law to give us the power, and then it won’t happen next time.’

“This is all a charade because the reality is the regulators had the power, they just refused to enforce it. And the people who did the bad things should have been prosecuted. What we should have been doing is actually using the power that we had.

“Think of it this way, over the past year the Fed, the OCC, and the SEC have been doing an amazing number of things. They haven’t been granted new power to do it. They’ve been using the power they’ve always had, but never called upon. Why didn’t they call upon it before?

“I’ll give you an example from personal experience. We tried to investigate sub-prime lending back when I was AG (Attorney General). We went and served subpoenas and wanted to gather the data. I’d written an article in The New Republic in 2004 saying: ‘This debt’s not going to be repaid, this is bad stuff.’

“The OCC and the banks went to court to stop us from serving the subpoenas and getting the information. They said ‘You’re pre-empting.’ We had to litigate all the way to the U.S. Supreme Court in order to get the power to actually ask the questions to get the information. But worst of all, it’s not as though the OCC and the other federal agencies said: ‘You stop. We are doing it.’ They just said: ‘You stop.’ Nobody was doing it. So the agencies who had the power simply didn’t use it, and this catastrophe simply grew and grew and grew.

“It’s the Peter Principle on steroids. We all know the Peter Principle, where people are promoted to their level of incompetence and they end there. What’s happened in DC is that people are promoted to their level of incompetence. And now, this will seem harsh, and I don’t want to say anything bad about people, but I will. Because of that incompetence, a huge crisis erupts, and they then use the crisis to argue that they should get even more power. And if you look at who is now in charge, it is basically the people who were in charge of the Fed and the Treasury and the OCC and the OTS throughout the time when this crisis was brewing.”

They say he didn't really wear the socks to bed...

But who cares? If the Democratic Party only gives you one fighter as strong as Eliot Spitzer, you ought to wear calf-length black knee socks in defiant pride.

Yes, of course you can order the t-shirts through me. The price is $20 a shirt plus shipping. Put in your order now through draftspitzer@gmail.com. We'll have a paypal account set up later this weekend.

Subscribe to:

Posts (Atom)